Welcome to the latest edition of The Road to Zero Report

The BVRLA’s Road to Zero Report is an annual assessment of the UK’s progress towards zero-emission road transport. Launched in 2019, it provides an overall ranking of progress before taking a deeper look at the respective performance of ZEV demand, infrastructure and supply. Progress for cars, vans, and HGVs are considered in isolation, due to their varying trajectories.

Report produced in association with

Cars | Vans | Trucks

How are they faring?

Cars

Cars show a mixed picture. Where incentives are right, such as salary sacrifice and company cars, strong growth continues. Where there are no incentives, demand has slowed. With the ZEV Mandate ramping up pressure on OEMs on the front end, the volume and spread of models are seeing good improvements. Any positivity is overshadowed by fundamental weakness in the used BEV market. As supply into the second-hand space grows, prices show no sign of stabilising.

Vans

The zero-emission van transition is facing gale-force headwinds and should be viewed as in crisis. Demand is fundamentally constrained due to the weak functionality of vans on the market and poor real-world total cost of ownership. Infrastructure is still focused on cars and does not cater to van needs. From bookability to universal fuel cards, more must be done. Until van fleets truly feel like the product, costs, and operations will work for them, the transition will continue to stall outside the largest fleets.

Trucks

It is still early days for HGVs. Fleet figures are single digit, and technological uncertainty is no more resolved. There is extremely limited HGV specific infrastructure. The future looks brighter the Zero Emission HGV and Infrastructure Demonstrator programme (ZEHID) - will put a network of 57 recharging and refuelling sites into service [3] over the next 12-18 months, through four funded projects [4]. Operators are excited about the ZEHID results, and a number of private sector small-scale pilots are starting to generate insights.

Cars

A mixed picture. Where incentives are right, including with salary sacrifice and company cars, strong growth continues. Where there are no incentives, demand has slowed. The ZEV Mandate has ramped-up pressure on OEMs and the volume and spread of electric models has increased. All this positivity is overshadowed by fundamental weakness in the used BEV market. As supply into the second-hand space grows, prices have slumped and show no sign of stabilising.

Vans

Facing enormous headwinds, the zero-emission van transition is in crisis. Demand is constrained by the weak functionality of vans on the market and poor real-world total cost of ownership. Infrastructure is still focused on cars and does not cater to van needs. From bookability to universal fuel cards, more must be done. Until van fleets truly feel like the product, costs, and operations will work for them, the transition will continue to stall outside of the largest fleets.

Trucks

It is still early days for HGVs. Fleet figures are single digit and technological uncertainty is unresolved. HGV-specific infrastructure is extremely limited. The future looks brighter. The Zero Emission HGV and Infrastructure Demonstrator programme (ZEHID) will put a network of 57 recharging and refuelling sites into service [1] over the next 12-18 months, through four funded projects. [2] Operators are excited about the ZEHID results and small-scale private sector pilots are starting to generate insights.

Key Themes

Demand

Remains strong in business car leasing with new ZEV additions being driven by salary sacrifice and company schemes. For vans, demand has stalled. Personal leasing reflects a UK-wide trend with a slight decline in ZEV new additions. Rental utilisation of ICE vs ZEVs demonstrates very limited rental demand for ZEV cars and vans. Heavy discounting means the price gap between ICE and ZEV vehicles is falling, but cost of ownership is still an issue due to high public charging costs and overall new vehicle price inflation. Used ZEV prices continue to fall and this volatility is undermining confidence amongst fleet owners and leading to higher new vehicle lease rates.

KPI's for Demand

The key performance indicators used to track demand levels

Rental Customer Demand

2024: Parked

2023: Parked

Business Leasing Demand

2024: Accelerating

2023: Cruising

Percentage of ZEV cars in leased fleet

Percentage of ZEV cars in leased fleet

Percentage of ZEV vans in leased fleet

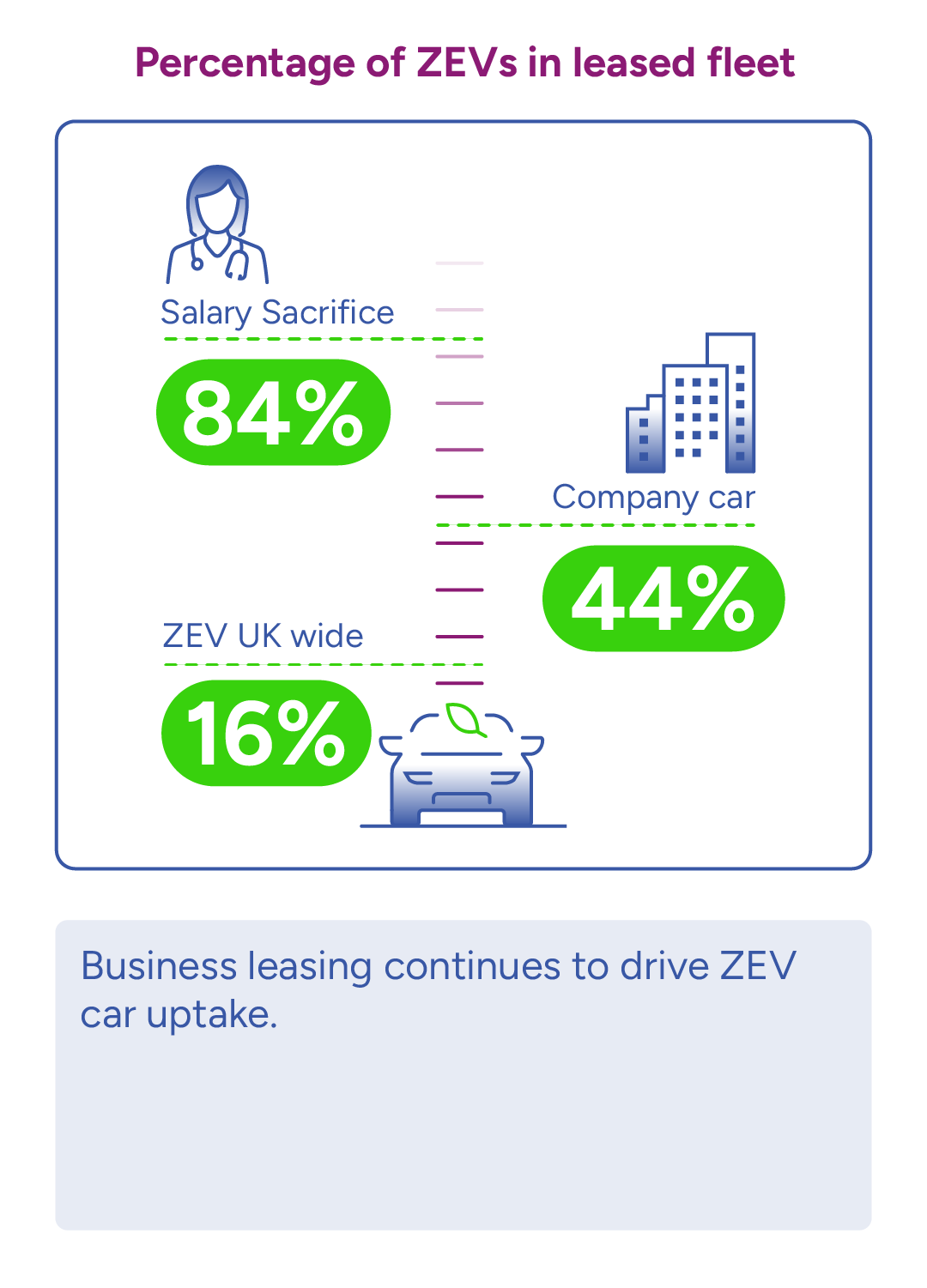

Percentage of ZEV cars in leased fleet – ZEV share of cars in business leasing has grown from 25% in 2023 to 37% in 2024, driven by new additions in company cars (44%) and salary sacrifice (84%). This remains far ahead of the UK wide ZEV uptake of 16%. [BVRLA]

Percentage of ZEV vans in leased fleet – BEV vans had a 7.2% share in Q1 2024, rising from 3.4% in Q4 2023. Despite this growth, new additions in the same period fell from 10.2% to 9.2%. Indications are that demand will drop in line with the general trend. [BVRLA]

Cost of Ownership

2024: Brakes on

2023: Brakes on

Cost of fuel and energy (public)

Cost of fuel and energy (public)

Cost of fuel and energy (home)

Cost of vehicle

Cost of vehicle

Cost of fuel and energy (public) – The average EV pence per mile (ppm) when using public rapid/ultra-rapid chargers (23ppm) has increased since 2023 and remains more expensive than petrol/diesel (16.5 ppm). [Zapmap]

Cost of fuel and energy (home) – After a slight increase in the first quarter for 2024, the Ofgem price capped domestic tariff reduced in April to 24.5p/kWh. The average pence per mile (ppm) of driving an EV using home charging (7ppm) is significantly cheaper than petrol/diesel (16.5ppm). [Zapmap]

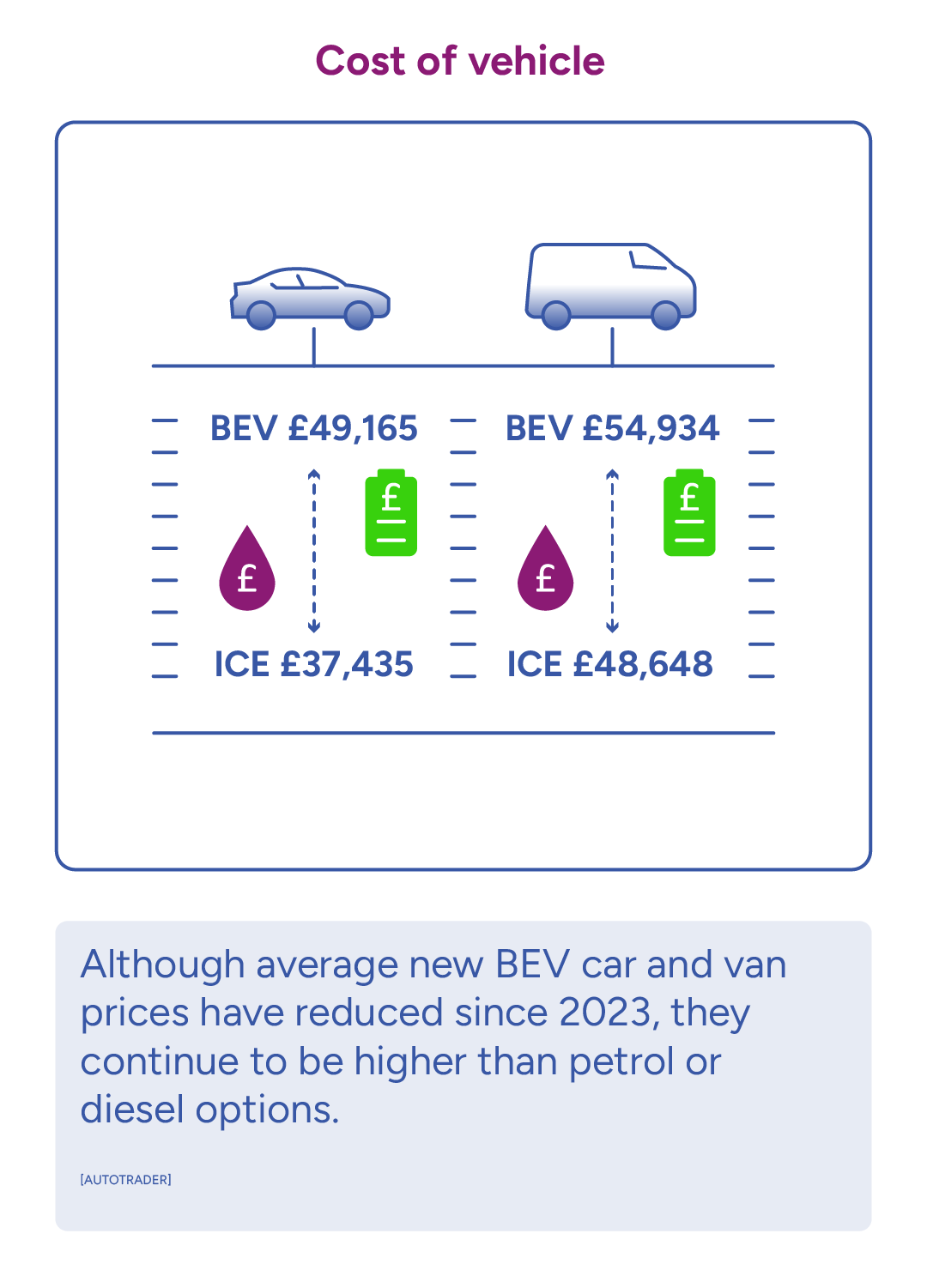

Cost of vehicle – The median price of a new BEV car has reduced from £52,035 in 2023 to £49,165 but remains higher compared to an ICE car at £37,435. A similar story is seen for vans with the median price of a new BEV van (£54,934) greater than an ICE van (£48,648) in 2024. [Autotrader]

Used ZEV Market

2024: Parked

2023: Brakes on

Supply vs Demand RV impact

Supply vs Demand RV impact

Percentage of dealers stocking EVs

Percentage of dealers stocking EVs

Used ZEV sell times

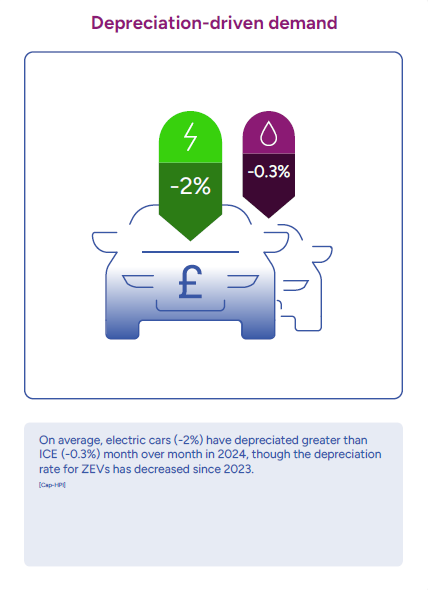

Supply vs Demand RV impact– The residual value of used EVs often serves as a proxy for demand, with lower values indicating reduced market interest. On average, electric cars (-2%) have depreciated greater than ICE (-0.3%) month over month in 2024, though the depreciation rate for ZEVs has decreased since 2023. [Cap-HPI]

Percentage of dealers stocking EVs – Only 43% of franchised dealers have advertised and stocked an electric vehicle in April 2024, this percentage drops to 19% for independent dealers. [CAP-HPI]

Used ZEV sell times – ZEV car sell times are marginally longer (31.6 days) compared to ICE (30.5 days) on average in 2024. While used e-vans are selling faster than last year, they are selling 9 days slower than used diesel vans. [Autotrader]

Did you know?

Key Insights

Demand

81%

Van utilisation for BEV

£49,165

Media RRP of new ZEVs

Rental Demand

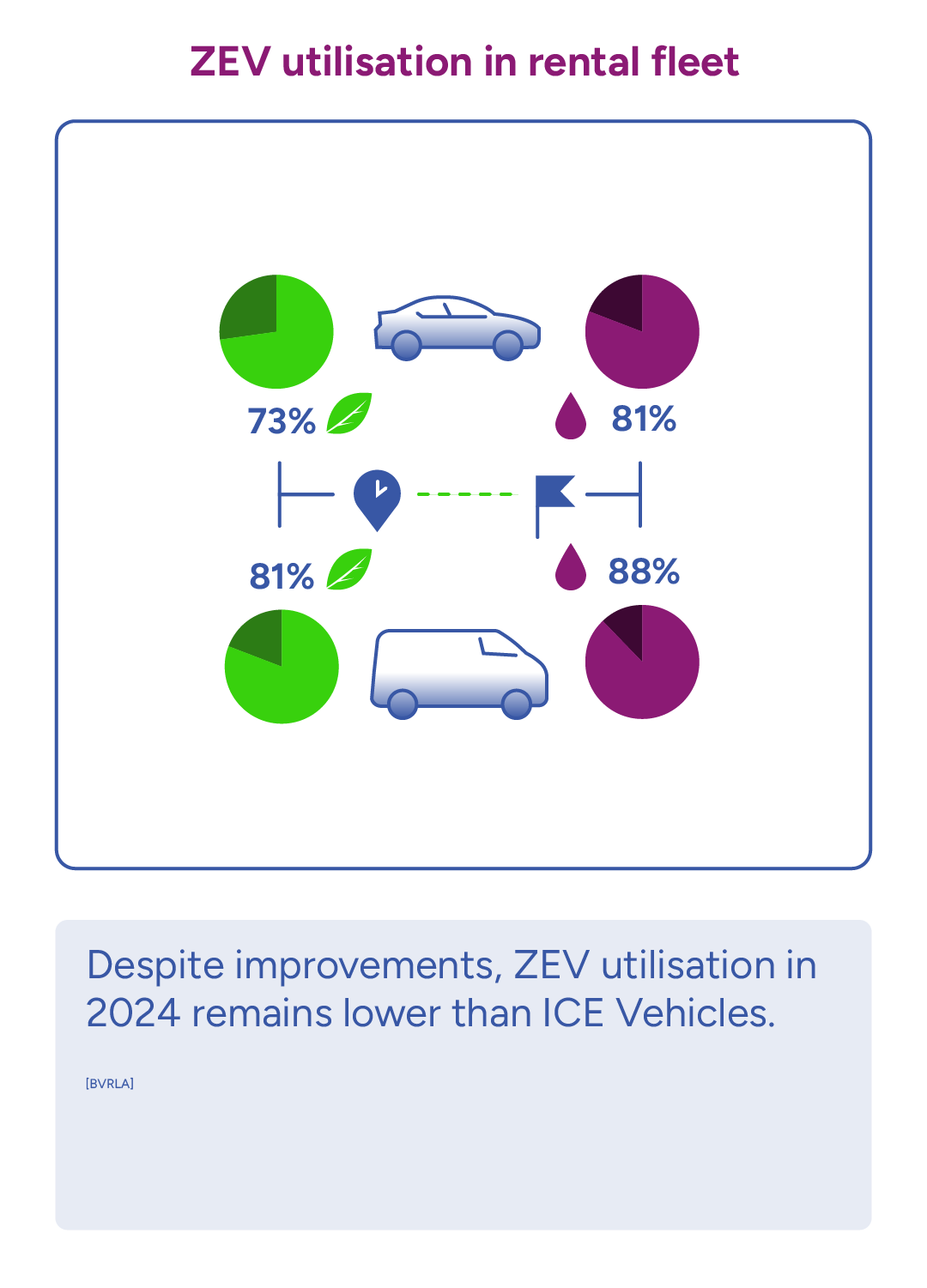

Rental firms continue to work hard to drive demand for ZEVs, but utilisation remains below that of petrol and diesel. Car utilisation is 73% for BEV vs 81% for ICE. Van utilisation 81% for BEV vs 88% for ICE. Utilisation for BEVs has risen compared to last year – rising from 62% for BEV cars in 2023 and 76% for BEV vans. This rise has been driven by huge efforts from rental operators. It cannot be sustained with larger fleets. Apprehension around charging availability and dwell time remains a crucial hurdle [D1]. For vans, vehicle capability is still an issue. The ZEV share of the total rental fleet remains small at 4% for cars and 1.5% for vans.

Business Leasing and Personal Leasing

As captured in the KPI – business car leasing continues to see good growth. The electric van market is not performing well. SMMT data shows a drop in market share in June 2024, falling to 4.7% year to date from 5.2% in June 2023. [D2] This slowdown is reflected in BVRLA business leasing figures with new BEV van additions to the leasing fleet falling from 10.2% in Q4 2023 to 9.2% Q1 2024. [D3] This reflects the general trend where, despite overall growth, demand for BEV vans has fallen 5.1% in the first six months of 2024. [D4] As OEMs monitor their progress towards the ZEV mandate targets, it is expected that they will push EV sales with tactical pricing. Fleet customers are reporting that OEMs are threatening ZEV quotas or ICE restrictions.

Personal leasing demand is well below business leasing and has fallen to a 16% market share of new additions in Q4 2023, compared to 19% the year before. Personal leasing costs are expected to fall with base interest rates and increased OEM discounts on EVs, but this may take time to impact leasing prices [D5]. A weak and volatile used market will undermine this. Some customers are delaying vehicle replacements in anticipation of lower borrowing costs and higher discounts [D6].

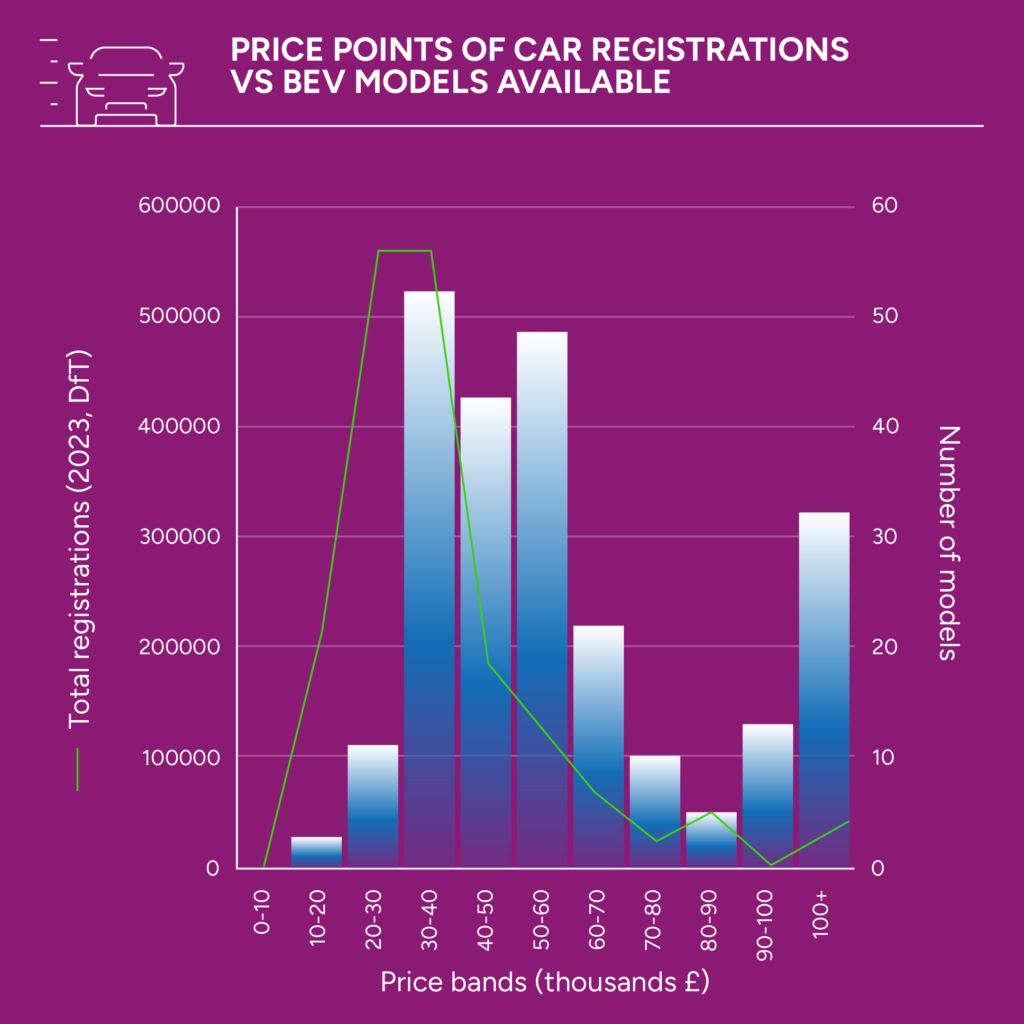

Vehicle Costs

Fleet and business demand is driving growth. Demand among private buyers is lagging with affordability, poor consumer confidence in charging and battery ranges being the key barriers [D7].Despite the average purchase cost of new ZEVs falling, with a median RRP of £49,165, the purchase cost of ZEVs remains 31% higher than their ICE counterparts as of April 2024 [D8].High levels of discounts from OEMs are expected as the ZEV mandate takes effect and sellers look to stimulate demand. According to Auto Trader, the average BEV retail discount rose from 5% last year to 10.7% by the end of May 2024. Competitively priced new entrants and increasing discounts are leading some to suggest we are nearing price parity for some models and via some finance products [D9]. Continued weakness in the used market threatens to undermine any progress towards parity.

Charging Costs

- The average cost of using public chargepoints increased 10% between April 2023 and April 2024, with prices for slow/fast devices rising more than rapid and ultra-rapid charging. This is making charging more expensive for drivers without access to a private chargepoint.

- According to ZapMap, economic uncertainty and cost pressures on charging networks has contributed to higher costs and means a drop in prices is unlikely in the near future [D10].

- As of 1 April 2024, the Ofgem standard unit price of electricity decreased to 24.5p per kWh, so those charging at home will see their costs decrease by an average of around £96 per year [D11].

- Energy suppliers are offering cheaper smart EV tariffs. As of March 2024, at least five EV tariffs offered off-peak prices of less than 8p/kWh [D12].

Used Battery Electric Vehicle (BEV) Market

Used EV prices have fallen for 21 consecutive months. The cumulative decrease in residual prices for EVs since September 2022 has been 51% compared to 11% for petrol.

On average, used EVs are now taking longer to sell than ICE, despite the overall days-to-sell having improved since 2023. Younger used EVs (3-5 years old) are selling faster than their ICE counterparts.

The used EV marketplace is largely made up of premium saloons and SUVs, with a lack of choice for lower-cost volume vehicles that typically sell faster [D13][D14]. Only 29% of used ZEVs sold were under £20,000 compared to the overall used market (83%) at the end of 2023 [D15].

Larger dealers are seeing their EV stock sell much quicker than smaller independent dealers, partly due to more aggressive pricing strategies to increase sales volumes [D16]. Crucially, most dealers are not stocking used BEVs.

With supply expected to continue increasing exponentially, used BEV market values are in crisis.

Graph source: cap hpi

Hear from the experts

Key Themes

Infrastructure

The number of chargepoints continued to increase and is tracking the exponential growth needed to reach 300,000 chargepoints in 2030. Charging experience got better, with reliability stats improving but not quite matching the Government’s reliability standard of 99%. Problems still exist with van accessible chargepoints, charging that can be booked and having universal coverage of EV fuel cards across the network. Despite DNOs meeting Ofgem targets for grid connections, real world experiences show problems persist and several government initiatives are seeking to resolve challenges and reform the connections process. Local authority engagement with fleets has shown signs of improvement but there’s still more to do.

KPI's for Infrastructure

The key performance indicators used to track demand levels

Public charging availability and reliability

2024: Cruising

2023: Cruising

Public chargepoint numbers

Public chargepoint numbers

Percentage of chargepoints out of service

Public chargepoint numbers continue to increase as does the rate of deployment. 2,687 devices were added in April 2024 compared to 1,677 in June 2023. The UK is continuing to track exponential growth towards 300,000 chargepoints in 2030. [DfT EV charging statistics]

Percentage of chargepoints out of service – The reliability of chargepoints is improving with 98.1% of all chargepoints in service between April 2023 and March 2024. Despite this, reliability across the rapid chargepoint network remains below the government’s target of 99%, with 96.7% in service. [Zapmap]

Public Charging User Experience

2024: Brakes on

2023: Brakes on

Percentage of network with live data

Percentage of network that is pre-bookable

Percentage of network that is pre-bookable

Ease of payment across network

Percentage of network that is van accessible

Percentage of network that is van accessible

Percentage of network with live data – Live data is available for 75% of chargepoints covered by Zapmap, which represents over 95% of the public charging network. As Zapmap’s coverage of the network has increased, the proportion of chargepoints with live availability data has decreased, but the total number continues to expand. [Zapmap]

Percentage of network that is pre-bookable –

Pre-booking is being explored by CPOs with limited trials of booking services planned or underway. However, it is not available across the network, with no evidence of booking services found with the major EV fuel card providers.

Ease of payment across network – The number of chargepoints covered by EV fuel card continues to grow. One provider covers 85% of the public charging network while two others cover over 50%. Progress is ongoing towards the government target of 100% of chargepoints aligning their services with a roaming provider. [EV fuel card providers, Zapmap]

Percentage of network that is van accessible – Although van accessibility continues to be a key issue for users, there have been no developments on monitoring or reporting van accessibility at EV chargepoints.

Ease

of

Implementation

2024: Brakes on

2023: Brakes on

Average grid connection times

Average grid connection times – The latest available data for 2023 indicates that DNOs continue to achieve targets on time-to-quote and time-to-connect. However, real world experiences show problems persist and several government initiatives are seeking to resolve challenges and reform the connections process. [Ofgem]

Local Authority Engagement

2024: Brakes on

2023: Parked

Engagement with fleets

Engagement with fleets – Local authority (LA) engagement has improved in the last year. 39% of LAs with an EV strategy show some evidence of engaging with fleets, an improvement on 20% last year. However, there is room for further improvement, with only 5% of LAs showing evidence of clear engagement efforts. [BVRLA Fleet Friendly Charging Index]

Did you know?

Key Insights

Infrastructure

18,000

New chargepoints added in the last 12 months

44

Councils have now been given LEVI funding

Public chargepoint deployment & reliability

![]()

The UK’s public chargepoint network continues to grow, with over 18,000 new chargepoints added in the last 12 months – bringing the total to 61,232 devices across 32,697 locations as of the end of April 2024 [I1].

The UK continues to track an exponential path towards the Government’s aim of 300,000 chargepoints by 2030. The level of growth required will become more challenging as we near 2030.

Reliability of chargepoints has improved – with a reduction in out-of-service chargepoints from 4.5% in June 2023 to 1.4% in April 2024. Further progress is needed if we are to meet the Government target of 99% by November 2024 – when it is currently 98.1%.

Data indicates that rapid chargepoints installed after 2022 are, on average, more reliable than earlier models. However, recently installed slow/fast chargers are slightly less reliable than those installed before 2022 [Zapmap].

The geographic distribution of chargepoints continues to be uneven, with much of the installed capacity in London and the South-East of England. The North-East has experienced the fastest growth in deployment so far this year [I2].

Public charging user experience

The Public Chargepoint Regulations stipulate that CPOs make open data available by November this year [I3]. According to industry experts, meeting this deadline will be a significant challenge, with only two CPOs currently providing open data in compliance with the regulations.

The regulation has also seen improvements that ensure all rapid chargepoints (>50kW) and all new chargepoints over 8kW are contactless enabled. This means drivers can make payments with ease without the need for multiple apps.

One area the regulations do not yet cover is ensuring the accessibility of chargepoints. Plans to monitor the proportion of the network which is compliant with the PAS-1899 accessibility standards are in development, but unfortunately, most chargepoints today have not been designed with disabled users in mind [I4].

Van accessibility also remains an issue. Not only is the size of bays often unsuitable for a larger vehicle, chargepoints are not yet bookable, nor is there universal coverage for EV fuel cards. Vans urgently need a specific focus from CPOs.

One major fuel card provider now covers over 85% of the total network. Two other major providers cover over 50% of devices, and over 75% of rapid chargers across the UK.

Ease of implementation

Ofgem data indicates that Distribution Network Operators (DNOs) are achieving targets on the average time taken to provide customers with a quote and connection. The most recent targets were set at 4.1 days for average time-to-quote and 35.7 days for average time-to-connect. Ofgem’s significant code review (2023) has helped to bring down some of the connection costs, but BVRLA member feedback suggests that in many cases, cost remains a key barrier. Another issue is the complexity of the process and lack of standardisation across the DNOs. To address these challenges, the government has implemented measures in the Plan for Drivers and the Connections Action Plan to review and simplify grid connections and chargepoint installations [I5][I6]. Following engagement between the BVRLA and the Energy Networks Association, new guidance that helps operators navigate the connections process is expected later this year.

Local Authority Engagement

Local Authorities (LA) with an EV strategy rose from 37% in 2023 to 47% in 2024. The numbers with dedicated contacts increased from 38% in 2023 to 57% in 2024. This is likely to be due to the Local EV Infrastructure (LEVI) capability fund. The numbers actively engaging with the fleet community are still small – 5% showing evidence of clear engagement, up from 3% in 2023. Over 60% of LAs are yet to engage with the fleet sector. [I7]. With LEVI funding having been allocated to 44 councils, it is vital that LAs start consulting fleets in their plans [I8].

Hear from the experts

Key Themes

Supply

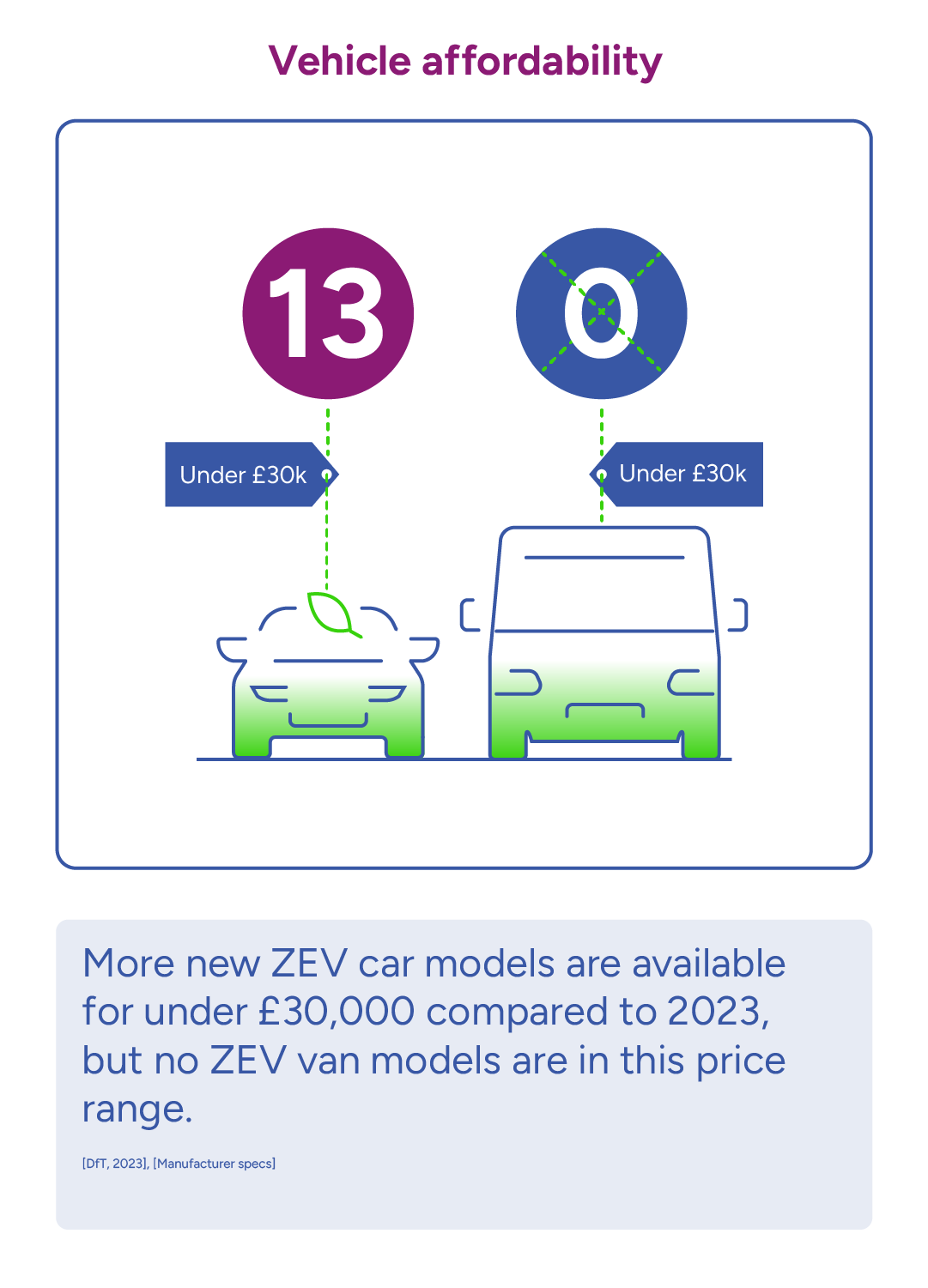

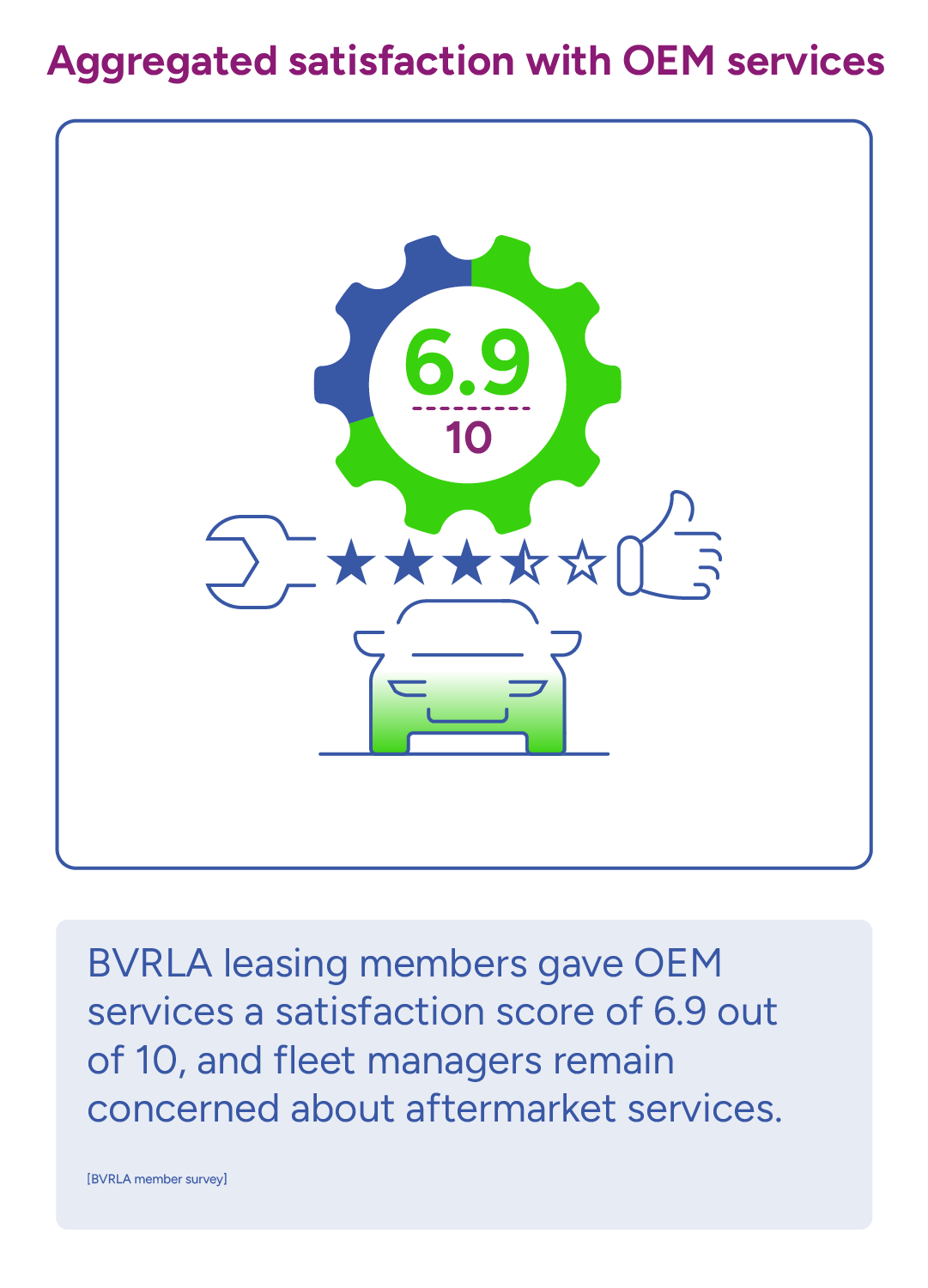

The absolute number of affordable ZEV models has increased marginally (from 11 to 13), but they have in fact fallen as a proportion of total ZEV models, from 9% to 5%. There have been ongoing improvements in vehicle efficiency for cars, vans and trucks and vehicles able to take a faster charge. Despite some improvements in the minimum range for vans, real world ranges are still lacking. The ZEV mandate’s introduction has brought some challenges as it beds in and it’s clear that we are a long way from meeting the trajectories set in all segments, especially for vans. Aftermarket services continue to present a challenge for ZEVs. More widely, an ageing workforce and unfilled technician vacancies are contributing to rising repair times and costs.

KPI's for Supply

The key performance indicators used to track supply levels

ZEV Product Suitability

2024: Accelerating

2023: Accelerating

Vehicle affordability

Vehicle efficiency

Vehicle charging speeds

Vans minimum range

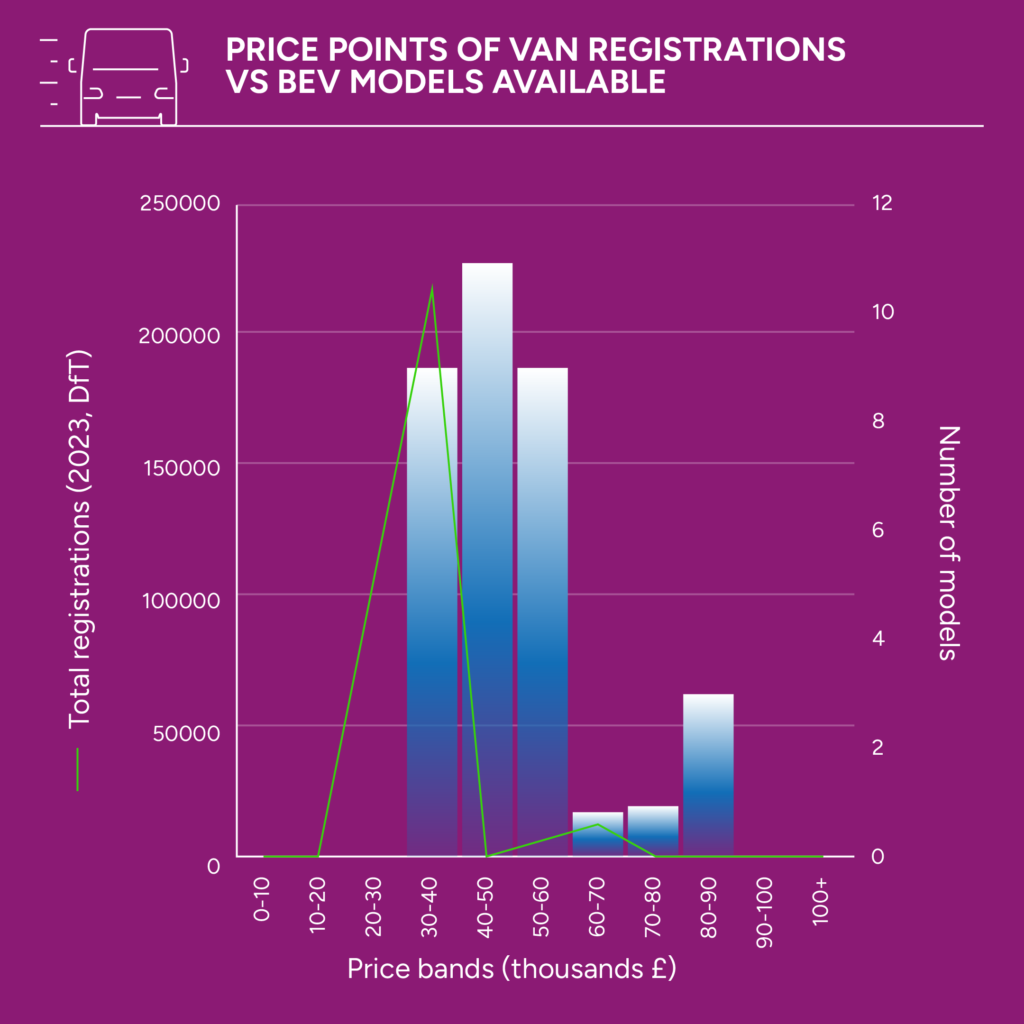

Vehicle affordability – While the overall number of new ZEV models under £30,000 has increased from 11 to 13 since 2023, this represents a fall from 9% to 5% of total models [DfT, 2023], [EV Database]. Following 2024 price updates, there are no ZEV van models below £30,000 [DfT, 2023], [Manufacturer specs].

Vehicle efficiency –

Cars reporting efficiency of greater than 3 mi/kWh have increased to 84% from 75% in 2023 [EV Database].

Vans reporting efficiency of greater than 3 mi/kWh have remained constant at 43% [EV Database]

HGVs reporting efficiency of greater than 1 mi/kWh have increased to 67% from 33% in 2023 [Manufacturer specs, Ricardo analysis].

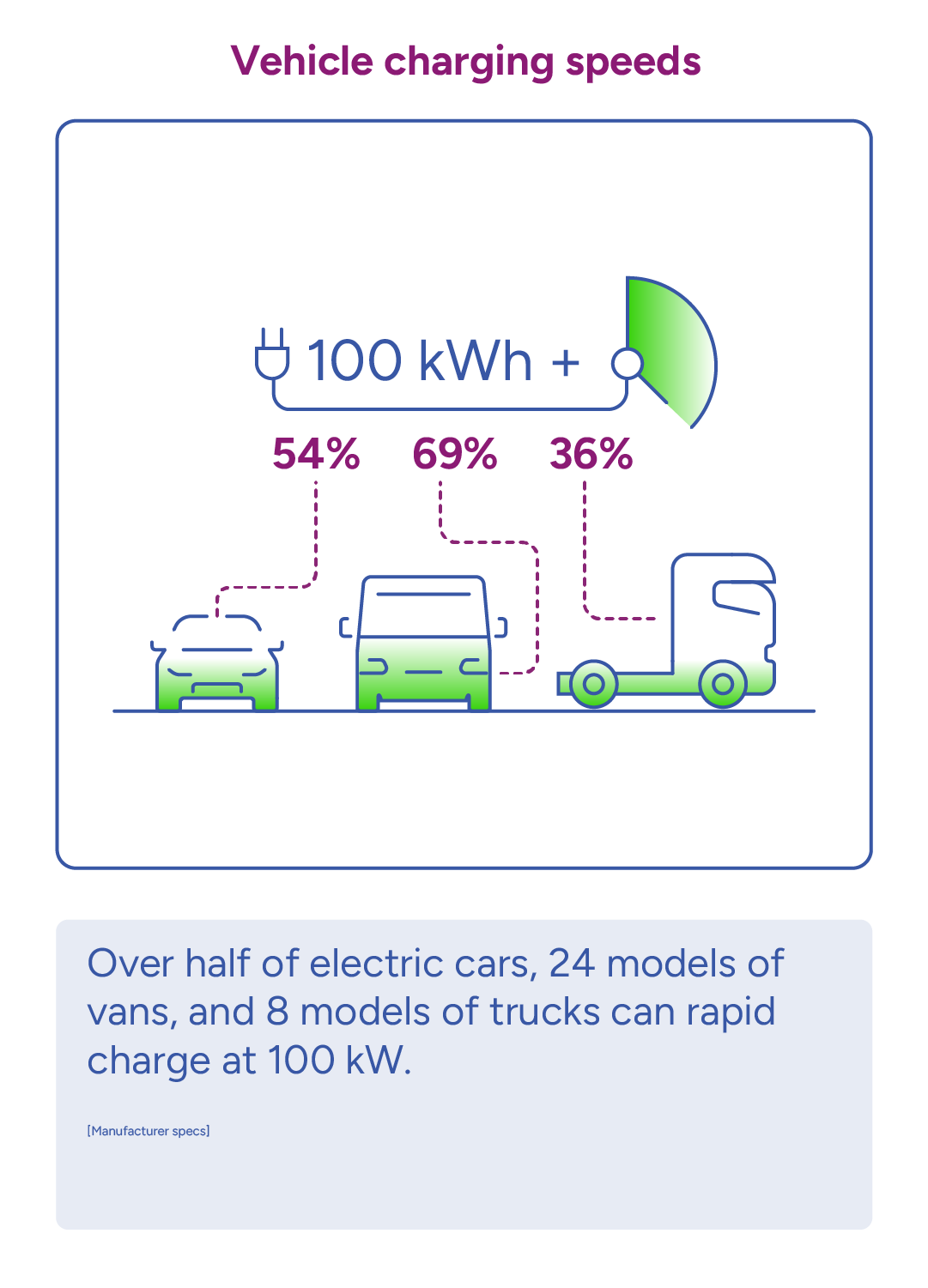

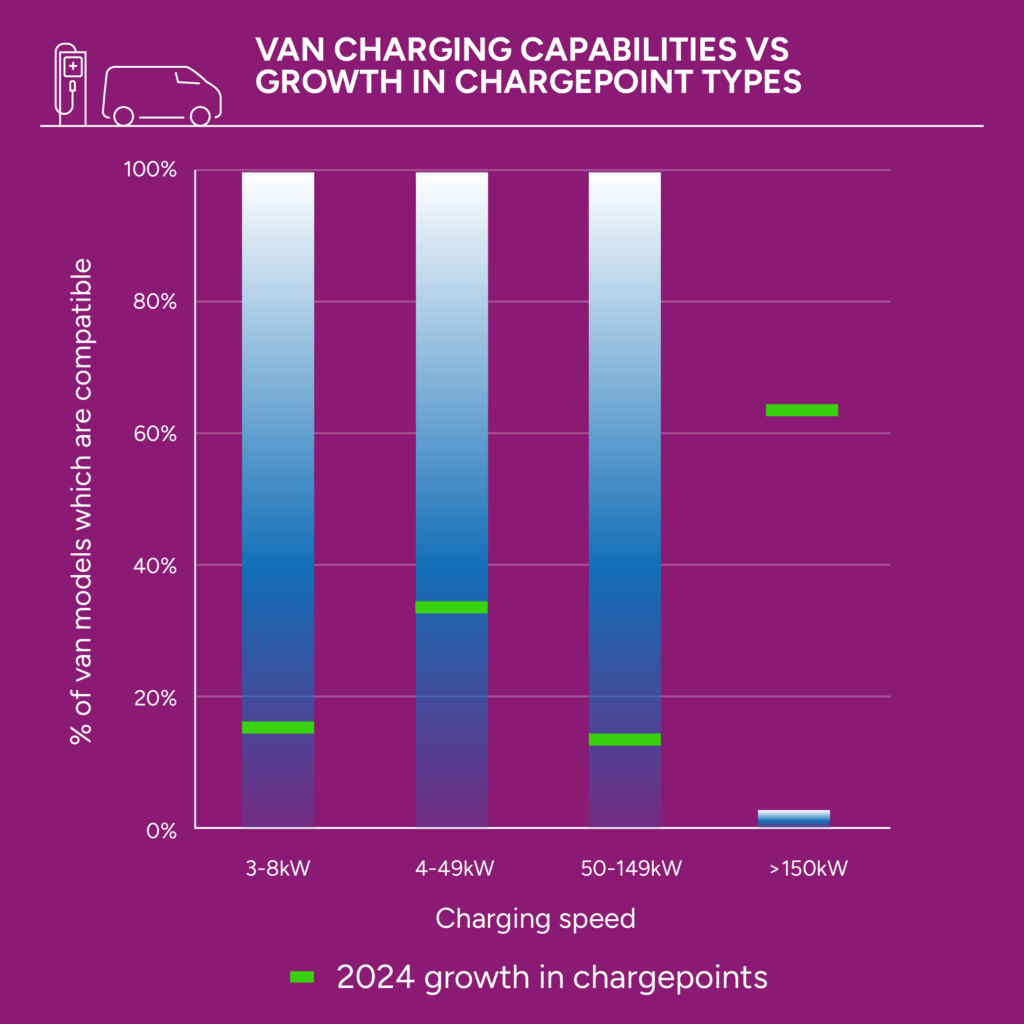

Vehicle charging speeds –

Over half (54%) of electric cars offer charging speeds greater than 100 kW.

69% (24 models) of vans and 36% (8 models) of trucks accept rapid DC charge at 100 kW [Manufacturer specs].

Vans minimum range – 15 of the top 35 selling electric van models had a range greater than 200 miles, an increase from 7 models in 2023. However, real-world range is significantly reduced when considering payload and temperature [Manufacturer specs].

ZEV Product Satisfaction

New for 2024: Brakes on

Aggregated satisfaction with OEM services

BVRLA leasing members scored satisfaction for OEM services at 6.9 out of 10. Fleet managers are concerned by the impact on quality of aftermarket services resulting from the recent transitions from traditional dealerships to agency models. [BVRLA member survey]

ZEV Sales and Manufacturing

2024: Accelerating

2023: Parked

Percentage of sales that are ZEV

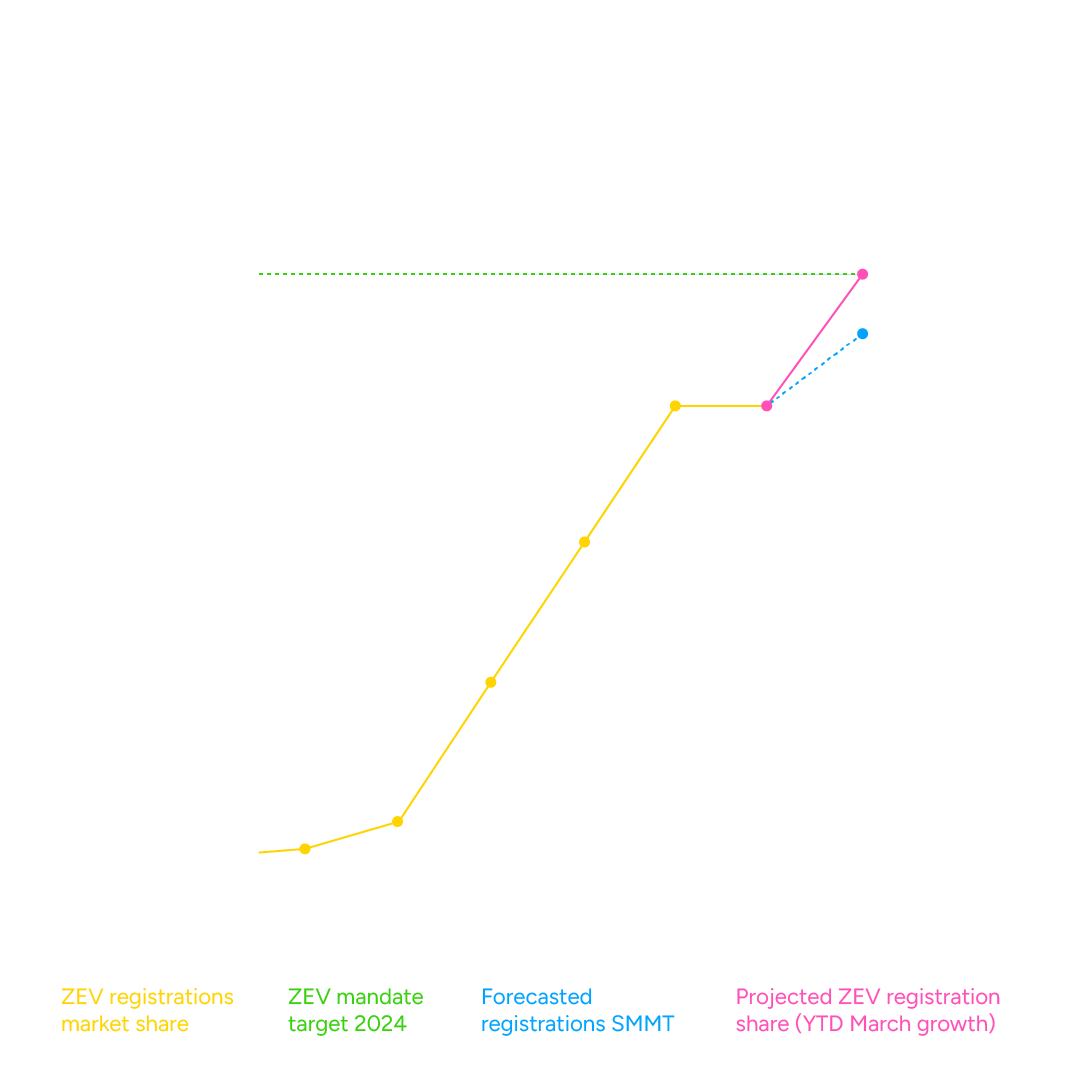

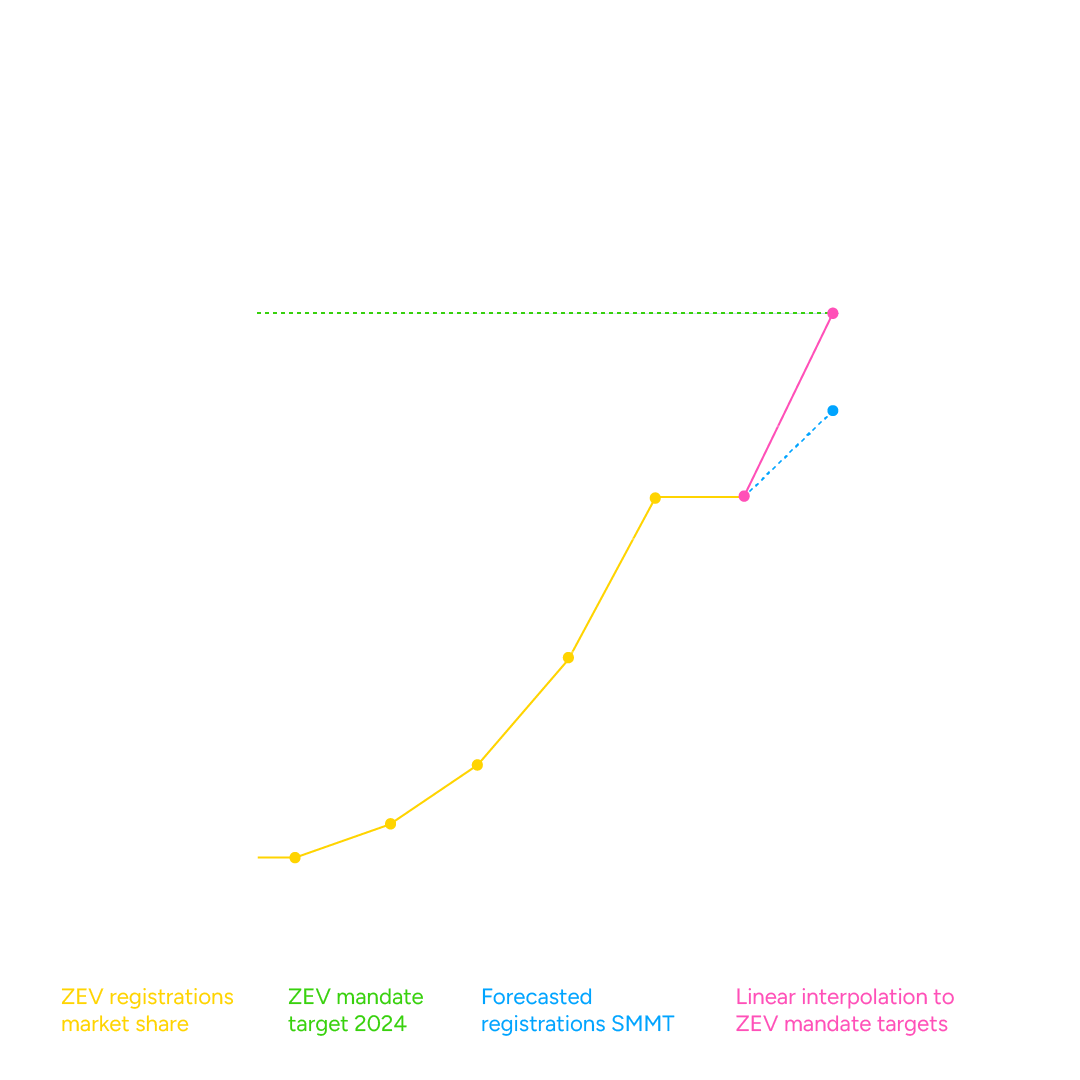

Latest SMMT forecasts show market wide BEV registrations reaching 19.8% for cars and 8.3% for vans, missing the headline 2024 ZEV mandate targets but likely to meet market wide targets when accounting for allowances in 2024 [SMMT – UK new car and van forecast – April 2024, New Automotive Electric Car Count].

Aftermarket

Services

2024: Brakes on

2023: Cruising

Number of qualified ZEV technicians

ZEV repair times and costs

Number of qualified ZEV technicians – The number of TechSafe qualified technicians reached 56,400 (22% of all technicians) by March 2024, maintaining the surplus of EV-trained technicians seen in 2023 [IMI]. However, there is concern around the overall availability of technicians and regional disparities exist.

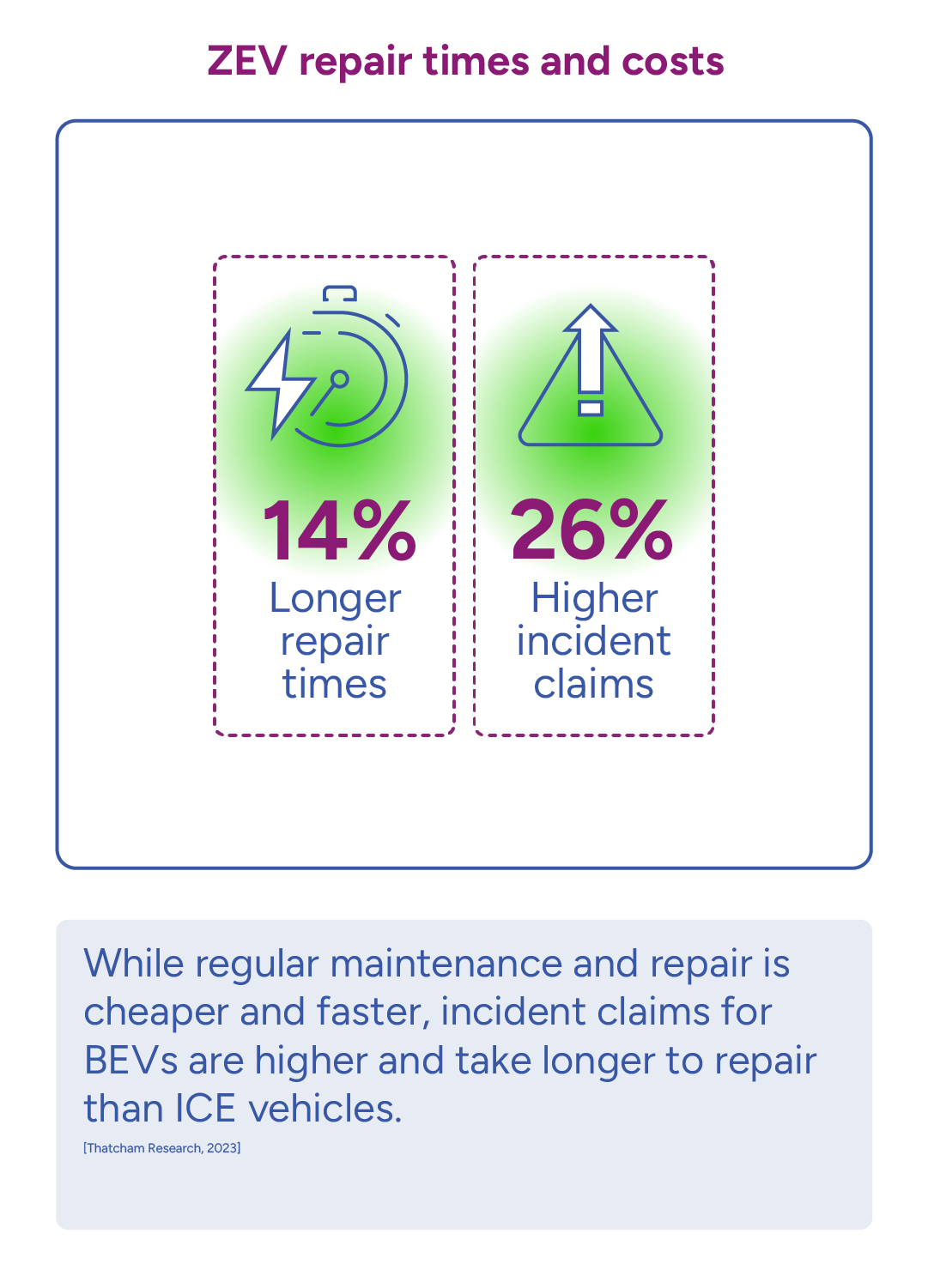

ZEV repair times and costs – Regular maintenance, repair times and parts costs for BEVs remain lower than ICE counterparts in 2024, with the gap increasing to 30% shorter repair times and 50% lower parts cost [Fleet Assist]. However, incident repair claims for BEVs are around 26% higher than ICE and take 14% longer to repair [Thatcham Research, 2023].

Did you know?

Key Insights

Supply

75%

of EV drivers wouldn't go back to petrol or diesel

Vehicle affordability

As ZEV ownership moves past ‘early adopters’ into the more price-sensitive ‘early majority’ market segment, there is a shift in the average consumer profile towards greater reliance on public charging and greater demand for lower cost vehicles.

The rising cost of public charging and the lack of vehicle choice across lower price bands is a dual threat to wider uptake.

Where it does work, ZEVs bed in. A recent survey by a leasing company found that over 75% of EV drivers wouldn’t go back to petrol or diesel, with significant annual savings reported ranging from £1,000 to £5,000 compared to ICE alternatives [S1]. However, around half of EV drivers also own a petrol or diesel vehicle, suggesting some hesitation in transitioning to electric vehicles fully [S2].

Vehicle suitability

A reported side effect of the recent improvements in vehicle specifications has been a delay by some fleets to switch to ZEV. Until technology improvements and price reductions start to level out, there will be concern about missing out on higher performance vehicles and stranded assets.

The past year has seen improvements in the specifications of commercial vehicles with van ranges, efficiency and charging speeds increasing significantly across existing and new model lines.

Nearly all vans and over half of trucks are now capable of rapid charging (>50 kW), whilst around half (47%) of the most popular van models have a quoted range greater than 200 miles. They still lag significantly behind cars in both ranges and, crucially, their efficiency.

Whilst electric vans may appear suitable on paper, the reality of their real-world performance (i.e. range), strenuous utilisation, and challenges with public charging suitability can make them difficult to operate in practice.

Real-world electric range remains a key barrier for commercial vehicle adoption. Van performance is significantly affected by payload, with a payload of 50% found to reduce the quoted WLTP range by 20-25% [S3][S4].

Charging times are the top concern amongst van drivers according to a recent study [S5][S6].

Aftermarket technicians

The most recent IMI forecast continues to show an excess of TechSafe-qualified ZEV technicians in the near-term, and growth in the qualification rates compared to the same period last year [S7]. However, the IMI now predicts that there will be a deficit in trained EV technicians by 2030, two years earlier than the previous forecast.

This is driven by the anticipated rise in demand for EV aftermarket services and labour shortages across the sector as a whole [S8], [S9]. In April 2024, there were four vacancies for every employee in the sector.

There is also a regional disparity in ZEV technicians, and there is also a faster take-up of trained technicians in dealerships compared to independents.

Aftermarket down time

Fleet operators have reported that insurance claim costs and repair times for BEVs continue to remain higher than ICE. This is due to more specialised and complex repair technologies and processes and shortages in parts and skills for non-standard repairs. A 2023 report found that insurance claims following a BEV incident were around 25% higher than for ICE and took 14% longer to repair[S10].

New international research shows that almost one in five fleets are seeing a rise in vehicle downtime since 2023. This general trend has been driven by fleets operating older vehicles since the pandemic due to a lack of new vehicles, leading to greater maintenance and repair requirements. This is compounded by the short supply of spare parts for certain manufacturers and models [S11].

ZEV Sales

Current and projected electric car (left) and electric van (right) share of sales relative to the ZEV mandate target in 2024. (Ricardo analysis of DfT data (2024) and SMMT forecast (2024)

ZEV car sales continue to see growth. While the growth has slowed down, it is still strong.

Car growth is driven by the “fleet” sector, which accounts for more than four out of five new ZEV registrations [S12]

The fleet label hides significant underlying differences—from dealer pre-registration and rental to salary sacrifice and Motability vehicles, all are “fleet.” A deeper analysis is needed to truly understand ZEV sales progress.

What is clear for cars is that without the right stimulus, demand is weak.

Vans have a much starker picture. Demand is falling, not growing. Year to date, fewer BEV vans have been sold in absolute numbers in 2024 (8,353) compared to 2023 (8,803). Market share is also falling (down 0.5%) [S13]. The van transition is in crisis, and it seems highly unlikely that the forecasts for the year can hold up.

Hear from the experts

Deep Dive into the Key Challenges

Deep Dive

ZEV Mandate

The ZEV mandate was introduced into law in January 2024, requiring OEMs selling vehicles in the UK to meet successive annual reductions in non-ZEV share of their total annual sales. The share of ZEV sales will increase annually towards 2030 when 80% of new car registrations and 70% of new van registrations are ZEVs. This is part of the UK’s target to reach 100% ZEV sales in 2035 [ZM1]. During 2024, ZEVs must make up 22% of OEM’s new car registrations and 10% of their new van registrations, although flexibilities available in 2024-2026 can reduce the effective targets. Average CO2 emissions are also required to remain constant or decline over the same period through a parallel CO2 emissions scheme, which applies to OEMs’ remaining non-ZEV registrations.

Constraints in ICE supply could affect fleet operations and push prices up

After a slow-down in new electric van registrations and a plateau in the growth of electric car total registrations, SMMT’s latest annual forecast for 2024 ZEV registrations downgrades their October 2023 forecast from 22.3% to 19.8% for cars, and from 10.2% to 8.2% for vans [ZM2][ZM3].

A lack of public confidence has been attributed to the decline in ZEV registrations and revised projections, particularly from a lack of tax incentives for private buyers of cars and insufficient charge point infrastructure suitable for commercial vehicles [ZM4] [ZM5] [ZM6].

In line with cyclical annual trends, registrations are expected to increase in the second half of the year towards a peak in Q4, and there are already signs of OEMs ramping up sales. May saw electric cars take a 17.6% sales share in a 3rd consecutive month of growth [ZM7]. For vans, the future is less clear with sales refusing to increase, despite OEM pressures, given the weakness of the product and EV ecosystem. Without intervention, the van target looks completely unreachable.

Whilst there are concerns about overall ZEV registrations, several OEMs are on track to meet or exceed the minimum 22% threshold in 2024 [ZM8]. The remaining OEMs will be relying on the ability to borrow, bank, exchange and trade ZEV “credits” allowed in the early years of the mandate.

OEMs with large volumes of fuel-efficient vehicles but low ZEV sales can exchange credits between the CO2 and ZEV registration schemes to lower their effective registration threshold for 2024. Underperforming OEMs can borrow credits from future years or trade with OEMs who have exceeded their 2024 threshold. Outperforming OEMs can also bank their credits for use in future years. As such, some OEMs will be able to reduce the share of ZEV sales required for 2024, with the effective fleet-wide target for cars projected to be 17.6% compared to the headline 22% level [ZM9]. This means that the SMMT projection for the end-of-year 2024 ZEV car registrations will exceed the effective threshold if the ZEV Mandate mechanisms are utilised by OEMs [ZM10]. The ability to borrow and bank credits will be phased out by 2027.

In the near-term, OEMs are likely to adopt pricing and supply tactics to increase ZEV sales shares and avoid paying fines [ZM11]. This includes constraining the supply of non-ZEV models through a removal of low-end models, as was announced by Ford in May [ZM12]. OEMs will also be considering the channel mix of new sales. Fleets are also reporting increasing pressure from OEMs to accept BEV orders whilst removing ICE, with restrictions on orders without high ZEV shares.

There are concerns around the impact these tactics will have on the vehicle market. Constraints in ICE supply could affect fleet operations and push prices up, while price drops on new BEVs will pass through to the used market where depreciation is already a concern.

Deep Dive

Used BEV Market

Representing almost 80% of all cars purchased last year in Britain, the used vehicle market is critical in supporting mass adoption of ZEVs [UB1][UB2]. Despite BEV sales almost doubling in 2023 and a record market share in Q1 2024, the market continues to be dominated by ICE that make up 98% of all used car sales [UB3]. Volatility in the supply, demand and price dynamic of the used ZEV market is a key concern for the fleet sector and poses a threat to the ongoing transition away from petrol and diesel vehicles. An equilibrium needs to be found to support confidence in the fleet sector and among used vehicle customers.

Schemes such as newly launched used-EV salary sacrifice will further help to support uptake, but confidence will need to be restored among dealers

Central to the discussion on the used vehicle market is the depreciation of used EVs. Following months of price increases during Covid, as demand outpaced constrained supply, the used market has been realigning with significant price drops since 2023.

The rapid growth in supply of used BEVs in 2023 triggered the fall in used prices, and expectations are that 2024 will see a bumper injection of used BEVs into the market that will further test prices and demand [UB4]. As OEMs focus on the fleet sector to take on more BEVs in line with the ZEV mandate, it will become even more important that fleets can sell on their used vehicles through established channels. However, data from cap hpi indicates that only 43% of franchised dealers have advertised or stocked EVs in Q1 2024 and this number is even lower for independent dealers. For used EVs specifically, Carwow’s auction data shows that 58% of franchise dealerships and 81% of independent retailers stocking used EVs have fewer than five in stock [UB5]. This hesitancy, which has resulted from the volatility in the market, is affecting sales and putting further negative pressure on prices.

Another key challenge for the used BEV market is managing price pass-through effects from the new vehicle market, as cheaper brands reach the market and established players make price adjustments [UB6]. New BEVs are not just getting cheaper but also have higher specifications, as the release of new models brings improved range and efficiency. These new BEVs will compete with demand for used vehicles, threatening to further push down prices and exacerbate the market’s volatility.

These trends could also negatively affect adoption, as potential buyers of new and used BEVs may choose to wait for technology development and pricing to stabilise. However, OEMs are expected to adopt aggressive pricing and sales strategies to reach ZEV mandate targets, putting fleets in an awkward position.

Of course, the fall in BEV prices towards parity with ICE counterparts is good news for used buyers and should support growing demand [UB7]. Schemes such as the newly launched used-BEV salary sacrifice will further help to support uptake, but confidence will need to be restored among dealers, and issues around public charging costs and aftermarket services should be a priority for government action. Without stability, new buyers will also continue to see their assets depreciate rapidly, making new BEVs ever more expensive.

Deep Dive

Repair, maintenance and insurance

An electric vehicle is typically cheaper to run with lower maintenance and repair costs compared to an ICE vehicle, mainly resulting from fewer moving parts in its drivetrain. Recent research indicates that the top 10 selling petrol cars in 2023 could cost drivers around £700 a year more to run than EV equivalents [RM1]. However, repair times and costs can vary significantly, depending on the type and extent of damage, the specific make and model of the vehicle, availability of parts, and technician labour rates. This difference between routine servicing and more significant repairs is important to recognise.

1 in 5 fleets have seen a rise in vehicle downtime since 2023

On average, repair costs for BEVs are reported as 25% higher than their ICE counterparts [RM2]. According to a global insurance agency, accidental damage claims for EVs are 35% more costly than comparable claims for ICEs [RM3] with higher costs being driven by several factors [RM4] [RM5]:

EVs are more likely to be equipped with advanced technologies, such as driver assistance, which can be more complex to repair.

- High voltage battery repairs in more serious collisions can bring significant additional costs.

- The faster acceleration of EVs increases the margin for human error and, coupled with the fact that EVs are typically heavier, can lead to higher impact incidents.

Downtime for vehicles due to repairs is another issue being faced, with a 2024 survey of fleets finding that almost one in five fleets have seen a rise in vehicle downtime since 2023 [RM6]. Both downtime and repair costs are being impacted by the short supply of spare parts for certain models and a lack of technicians qualified to handle more advanced EV fixes.

There have been several industry reports suggesting that EVs are being written off at a higher rate than ICE counterparts, driven by prohibitively high repair costs [RM7]. However, analysis of 2023 DVLA data has found that electric cars are being written off and scrapped by insurers at half the rate of ICE cars. For cars up to three years old, 0.09% of EVs were scrapped in 2023 compared to 0.18% of ICEs. Extending the age bracket to five years old, 0.13% of EVs were written off compared to 0.33% of ICEs [RM8].

While scrappage rates may not be higher for BEVs across the fleet, the cost of repair is higher and remains an issue. Research also suggests that while new vehicle production methods by OEMs will lower up-front costs, the average cost of serious EV body and battery repairs may rise by 30% by 2027 [RM9] , which could affect scrappage rates [RM10].

An indirect impact of these repair challenges is to drive up BEV insurance premiums [RM11]. While the price of insurance is rising across multiple sectors [RM12], EV cover is around twice as much cover for ICE cars [RM13] and climbing faster. The average insurance premium for EVs jumped to £1,344 at the end of 2023.

Other BVRLA projects you may be interested in

Special thanks to:

Contributors

Autotrader

Allstar

Arval Mobility Observatory

BCA

Cap hpi

Fleet Assist

Hubject

Institute of the Motor Industry

New Automotive

Octopus Electroverse

Ofgem

Paua

Zapmap

Members

3B Vehicle Hire Limited |

Accident Repair Centre (Scotland) Limited |

ALD Automotive |

Alley Cat Car & Van Rentals Ltd |

Alphabet (GB) Ltd |

Arnold Clark Finance Ltd (HO) |

Arval UK Ltd |

Autohorn Fleet Services Ltd |

Avis Budget UK Ltd |

Close Brothers Vehicle Hire Ltd |

DAF Trucks Ltd |

Dawsongroup Vans Limited |

Enterprise Mobility |

Europcar Group UK Ltd |

Fraikin Ltd |

Herd Hire Ltd |

Hertz UK Ltd |

Kinto UK Ltd |

LeasePlan UK Ltd |

Leasys UK Ltd |

Lex Autolease Ltd |

Miles & Miles Ltd |

Novuna |

N.I.I.B. Group Limited |

Octopus Electric Vehicles Ltd |

Pendragon Vehicle Management Ltd |

Prohire Limited |

Radius Vehicle Solutions Ltd |

Reflex Vehicle Hire Limited |

Rivus Fleet Solutions Limited |

SG Fleet Solutions UK Ltd |

Sixt Rent A Car Ltd (HO) |

Thrifty Car & Van Rental |

Tusker |

United Rental Group Ltd |

Zenith |

ZIGUP Plc |